Roland Berger advises the aerospace, defense and security industries. We support OEMs, suppliers, agencies and investors.

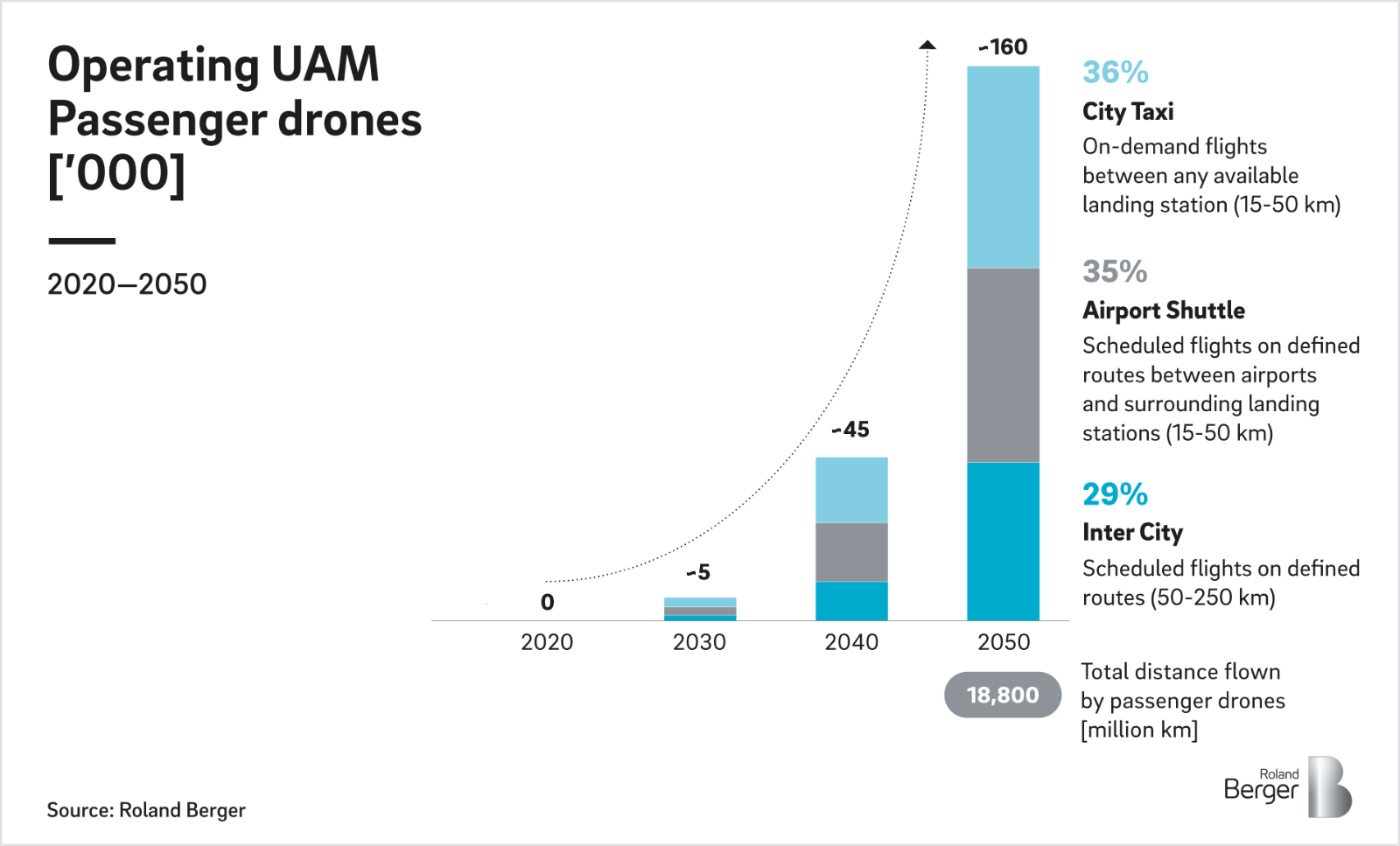

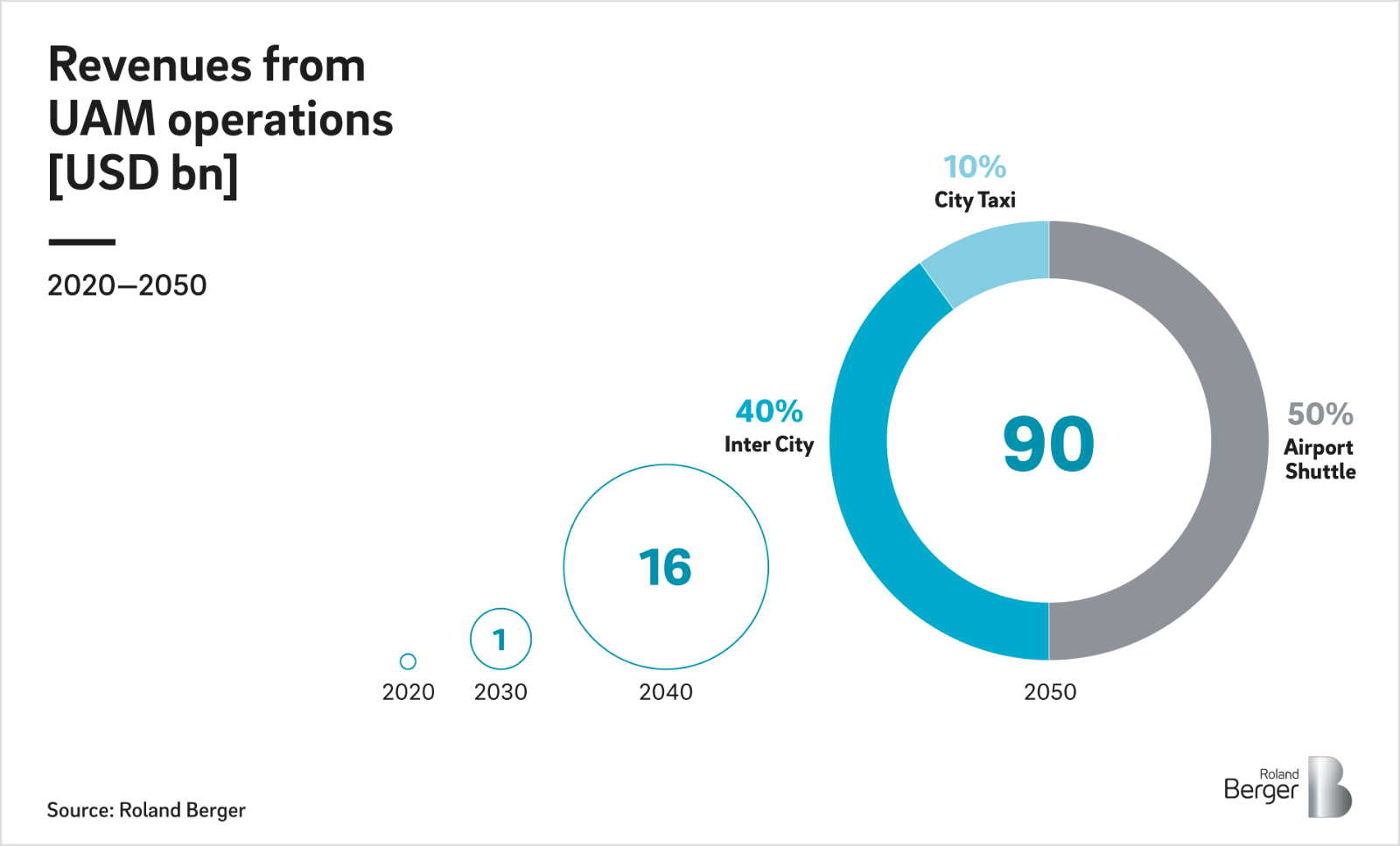

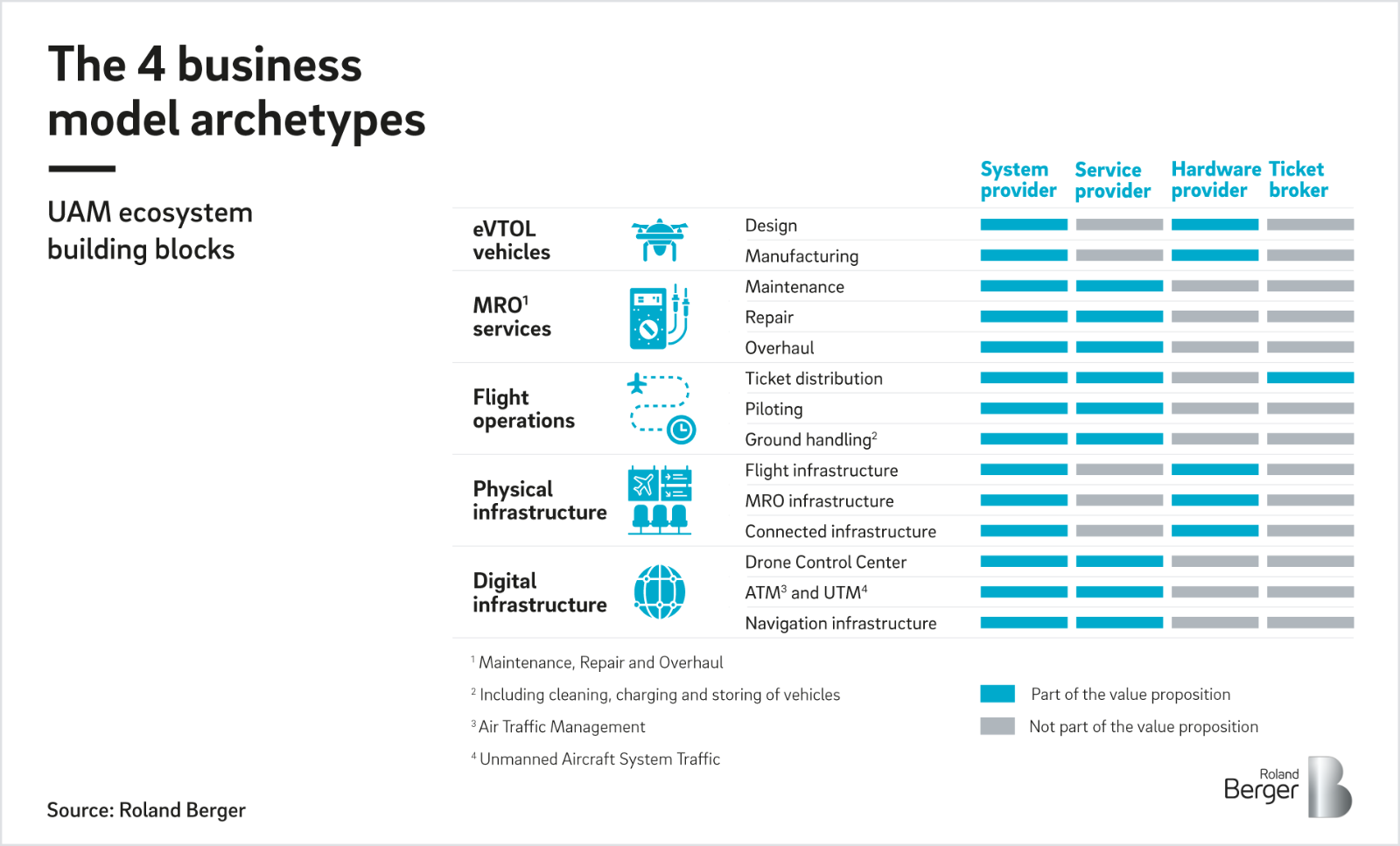

The high-flying industry: Urban Air Mobility takes off

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/RB_STU_650_Urban_Air_Mobility_2.0_Cover_download_preview.png)

Urban Air Mobility – an industry takes off. Investments are over 20 times higher than four years ago.