In our latest update on the economic impact of Covid-19 we take a closer look at the potential longer-term impact of the crisis on a range of key sectors.

Coronavirus

Immediate Measures For Companies

This campaign is outdated.

From securing liquidity to swiftly cutting costs: how to navigate the crisis and prepare for a ramp-up

Company measures:

360° Checkup

Scenario Analysis

Securing Liquidity

Covid-19 Emergency Room

Performance-Improvement Program

At operational level:

Operations Crisis Response

Spend Compression

De-risking the Supply Chain

Procurement Quick Wins

The Butterfly Principle: transitioning to the 'new normal'

Industrial support:

Mechanical Engineering Priorities

Performance Boost Automotive Suppliers

Securing Survival for Automotive Industry

Planned Rebound in Fashion and Lifestyle

GFC: Learnings for Mechanical Engineering firms

Fast help for banks in crisis

Targeted cost savings in IT

The "New Normal":

The automotive industry's road to recovery

Rethinking the Aerospace Industry

Reboot in tech-based industries

New normal in construction

Macro Analysis:

Corona Economic Impact - Part 1

Corona Economic Impact - Part 2

Corona Economic Impact - Part 3

Corona Economic Impact - Part 4

How to get the economy back up and running

The coronavirus outbreak is cutting a swath through the economy. It is intensifying the downward trend in many industries that were already stricken before the crisis, but even companies that were previously healthy are seeing their very survival threatened by disrupted supply chains and a collapse in demand. Depending on how the pandemic evolves and how long it lasts, we could be heading for a global economic crisis of unprecedented scope.

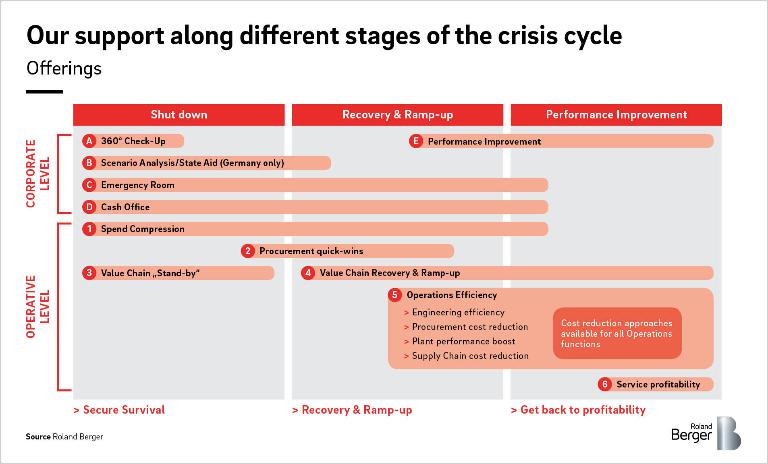

This makes it all the more important for companies to do the right things now, and do them quickly and systematically. That is about more than just surviving the coming weeks and months. It's about being prepared for what comes after that. As the market leader in restructuring and performance improvement, Roland Berger has a broad portfolio of measures available to help companies manage all phases of the crisis cycle with a view to coming out the other side.

Our program of quick wins for companies

In an initial 360° checkup , all operational and organizational risks associated with Covid-19 are quickly identified to keep the business from going under.

Scenario Analysis is conducted on the financial effects of the supply and demand shock and a cash office is put in place. These measures serve to keep the company solvent. Financial aid from the state can be applied for if needed.

In the Emergency Room , a Covid-19 task force constantly monitors further developments and ensures that the company is fully operational at all times.

The Performance Program focuses on the period after the acute crisis. Programs with short- and medium-term effects ensure profitability and optimize cash flow. A further aim is to ensure that the company is best prepared for when it is time to ramp-up production again.

Radically freezing spending and safeguarding supply chains: Protective measures for corporate operations

In addition to the overarching measures, we also support companies in shoring up their operational business . We enable massive savings and quick wins to be achieved rapidly. We also ensure that companies are optimally geared up for the economic recovery and, for example, that they can quickly access the resources they need.

Acting fast is crucial in unprecedented situations. In the current Covid-19 crisis, an immediate and radical freeze on all unnecessary expenditures must be brought in. Companies that do this can reduce indirect costs, project costs and CAPEX by 15 to 30 percent within a very short timeframe, depending on the industry, and thus achieve immediate effects on the profit and loss account or liquidity statement.

We recommend implementing a program of quick wins in procurement at the same time. Savings must be put into effect consistently and across all areas. Depending on the industry and company structure, savings of 3 to 6 percent can be achieved very quickly at category level. These quick wins rely not only on the classic levers of price and quantity, but on a whole bundle of innovative methods and digital tools that rapidly exploit all of the available potential to cut costs. That said, it is important to strike a balance between the savings that you can make and the financial stability of your suppliers.

As production is being largely shuttered worldwide, there needs to be a well-coordinated ramp-down of supply chains. We'll support you in keeping your supply chains on "standby" while everything is mothballed, not least protecting your network of strategic suppliers.

Covid-19 and its consequences: Tourism and retail are the hardest hit

With supply and demand patterns varying significantly, the coronavirus crisis is not affecting all sectors of the economy with the same level of intensity. The travel and tourism industry, alongside airlines and retail (except food retail), face the biggest battle with collapsing revenues and liquidity problems. But the financial sector and the automotive industry, which was already under pressure before the crisis, are also massively at risk.

Our Hibernation Task Force will assist companies in the automotive sector in ramping down and shuttering production facilities, implement rapid measures to secure liquidity and take extensive countermeasures to deal with the downturn to come.

In contrast to the financial crisis of 2008, banks are not the trigger this time but are the institutions that can help firms overcome the crisis. Banks face the challenge of stabilizing their operations on the one hand and ensuring the liquidity and thus the survival of their customers by offering pragmatic solutions on the other. It's important to start looking at the long-term effects of the crisis now and considering possible M&A activities or divestments for the future.

_tile_teaser_h260.jpg)

_tile_teaser_h260.jpg)